Investing 101

Investing 101 is a series on educational content related to stocks, markets and investing in general. Invest and Learn with Ursa! Not on Ursa yet? Download Ursa from the App Store!

While “Sell in May and Go Away” is a popular market slogan to predict a summer slowdown, historical data doesn’t seem to back it up and investment decisions shouldn’t be based on it.

Investing can be a wild ride, filled with catchy phrases and strategies that claim to hold the secret to success. One such phrase that has gained popularity is “Sell in May and Go Away”. But hey, before you jump on the bandwagon, let’s take a closer look at what this phrase really means and whether it’s all that it’s cracked up to be…

What’s “Sell in May and Go Away”?

Alright, so here’s the lowdown: “Sell in May and Go Away” suggests that you should sell your stocks or investments in May and sit out the market until September rolls around. The idea behind this catchy phrase is that the summer months tend to be a bit sluggish in terms of market performance with institutional investors on vacay.

Where Did It Come From?

Believe it or not, this phrase has some historical roots. Back in the day, there was an English horse racing festival held in September known as St. Leger’s Day. The saying went, “Sell in May and go away, come back again on St. Leger’s Day.” It somehow transitioned into the world of investing, with folks thinking that taking a break from the market during the summer could save them from volatility.

Is There Any Truth to It?

Well, here’s the thing: While it’s fun to think we’ve stumbled upon a magical formula, the reality is a bit different. The effectiveness of the “Sell in May and Go Away” strategy is highly debated. Those who support this strategy tend to pick and choose data that supports their case. Sure, there have been times when summer months showed weaker returns, but long-term data and other market factors need to be considered too.

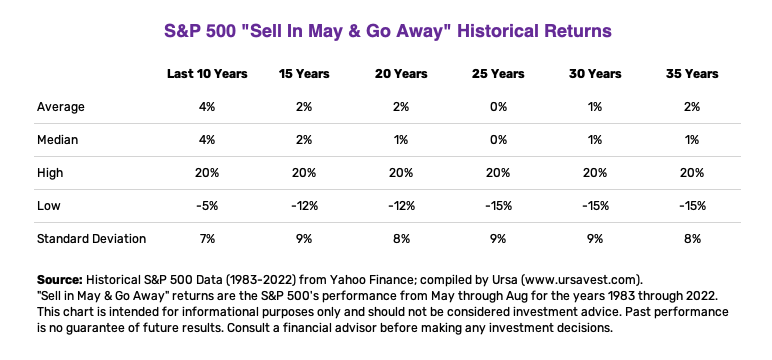

Using historical data, we took a look ourselves. In the past 30 years, the S&P 500 actually was up on average +1% across the four months of May thru August. The median return was also up +1%. However, the data is very volatile with the high of 20% during the pandemic recovery in 2020 and low of -15% in 2002 following the tech bubble burst. However, the S&P 500 did grow in all time periods we evaluated (see chart below).

So what does this mean?

In a nut shell, we don’t believe “Sell in May and Go Away” holds up as an investing strategy nor should drive investment decisions. You should also consider other investing factors before sitting out the summer as well including:

- Market Timing: Let’s face it, timing the market is like trying to catch a greased pig. Even seasoned professionals struggle with it. Relying on seasonal patterns might cause you to miss out on unexpected market upswings.

- Dividends: When you sell in May and go away, you might be missing out on dividends and other sources of income generated during the summer months. Dividends play a crucial role in long-term wealth generation and shouldn’t be overlooked.

- Costs: Frequent trading means more transaction costs like commissions and taxes. These costs can eat into your potential gains and make short-term strategies like this less attractive.

Think Long-Term Instead

Instead of going all-in on short-term strategies, you should focus on growing wealth through reducing risk through diversification and long-term investing instead.

Diversification means spreading your investments across different types of assets, sectors, and regions. By doing so, you can reduce risk and potentially increase your chances of steady returns.

Long-term investing is all about playing the long game. It gives your investments time to grow and benefit from compounding. Trying to time the market based on seasons might mess with your compounding magic and add unnecessary stress.

A portfolio manager like Ursa can help you invest in a diversified portfolio. You can automate recurring contributions and grow your wealth effortlessly. Then, maybe we can change the catchphrase to “Invest in May and Fly Away”! 😉

No Ursa account yet? Download Ursa here!

The statements, opinions and analyses presented here are provided as general information. This article is the opinion of the author. Anything within this article should NOT be considered an investment recommendation or advice. See Ursa’s full disclosures here.

Original Photo by Asad Photo Maldives.