For the past several months, we’ve been focused on using AI to make top-tier investment management accessible for everyone. We’re super excited to be releasing our new AI recommendations engine, Algo!

Currently, investment management for mainstream investors are either mutual funds or ETFs where you’re forced into cookie-cutter templates for mass-managed investments. We believe personalized investment management services should be accessible by more than just the wealthy.

So what’s Algo?

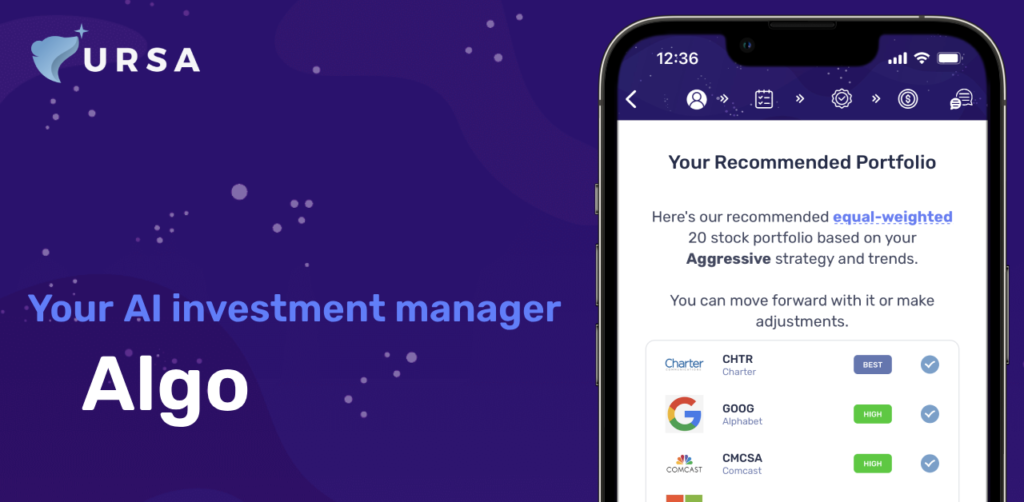

Algo is our recommendations engine which uses an AI predictive model to recommend stocks for your portfolio. Algo uses information from your investor profile, fundamental stock data and our in-house research to determine a compatibility score between a stock and your portfolio. Algo uses stocks’ compatibility scores to build and make adjustments to your portfolio as market conditions change. You can think of Algo as your AI investment manager.

So how does it work?

We’ve spent hundreds of hours over the past several months training Algo to “think” like an investment manager. Algo monitors and evaluates stocks in your portfolio and on our recommended list on an ongoing basis. Similar to before, Algo recommends stock swaps when it finds higher compatible stocks for your portfolio. We still review Algo’s recommendations for portfolios and continue to train the AI model with the new datapoints.

You can check out Algo in-app. Also stay tuned, we have more AI features releasing soon!

Not on the app yet? Download Ursa here!